The new Colorado GAP waiver legislation brought significant changes to the terms governing the sale and cancellation of Guaranteed Asset Protection (GAP) waivers in the state, including the fees that may be charged and refund requirements. The legislation went into effect January 1, 2024. This article provides key data points from the consumer finance protection legislation that affects auto lender compliance regarding the funding of GAP waivers in Colorado.

2024 Colorado GAP Waiver Legislation Highlights

Maximum Allowable GAP Waiver Fee

The cap for the GAP waiver fee has been set to the greater of 4 percent of the total amount financed or $600. This update is designed to balance the financial implications for both lenders and consumers, ensuring that fees remain fair yet reflective of the financial risks undertaken by lenders.

GAP Waiver Refund Process

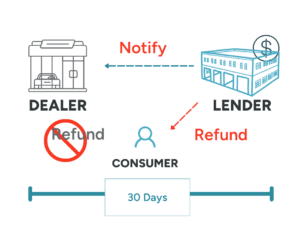

The Colorado GAP waiver legislation also calls for a rigorous protocol for refunding unearned GAP waiver fees to the consumer. In cases where finance agreements are reassigned, the assignee (auto finance company) is responsible for notifying the original creditor (auto dealer) of the refund due who is responsible for issuing the refund to the consumer within 30 days (Figure 1).

Should the original creditor fail to meet this deadline, the responsibility falls to the assignee to make the refund (Figure 2). Furthermore, the law mandates that the original creditor or administrator of the GAP waiver must reimburse the assignee within 45 days of receiving the original notice from the assignee.

For auto lenders, understanding the nuances of this refund mechanism is crucial. The Colorado GAP waiver legislation specifies that refunds after the full payment period must be pro-rated, with a cancellation fee now limited to $25.

This clarity in refund processes was designed to streamline operations and reduce conflicts, enhancing consumer trust in automotive financing arrangements. But it will require lenders, dealers and GAP waiver administrators to review their engagement and communications protocols to ensure compliance with the 30-day refund deadline.

GAP Waiver Requirements

The law also sets strict guidelines for the inclusion of conditions in GAP waivers, detailing how deficiency balances should be calculated in the event of a total loss. It goes as far as to require auto lenders to provide consumers with clear, comprehensive disclosures about the benefits, terms, conditions, and exclusions of GAP agreements.

These disclosures must include boldface notifications and a precise description of the claims submission process after a total loss, ensuring transparency and adherence to regulatory standards.

Moreover, the legislation enforces several consumer protections, such as mandatory refunds of unearned GAP fees if a vehicle is repossessed or if the finance agreement is prematurely settled. It also outlines specific steps for canceling a GAP waiver and sets a minimum coverage of $500 for deductibles, with provisions for additional coverage.

Unearned GAP Waiver Fee Refund Trigger Events

- Early loan payoff. When a consumer pays off their auto loan before the full term.

- Vehicle repossession. When the vehicle is repossessed because the consumer defaulted on the loan.

- Total loss of the vehicle. If the vehicle is totaled in an accident or stolen. But this only applies if the total loss is not a loss covered by the consumer’s auto insurance.

- Cancellation of the GAP waiver. As GAP waivers, like other vehicle protection products, are optional, consumers have the right to cancel their GAP waiver any time.

F&I Sentinel is the industry’s trusted provider of managed compliance solutions – from funding to servicing to refunds. Our CITADEL® and Express Recoveries platforms help auto lenders navigate the regulatory landscape surrounding the financing and resolution of voluntary protection products. Schedule a no-obligation meeting with a member of Concierge Compliance team today.

The information provided in this post does not, and is not intended to, constitute legal advice; instead, all information, content, and materials referenced are for general informational purposes only. Readers should contact their attorney to obtain advice with respect to any particular legal matter.